As a consumer, you have more options than ever when it comes to financing major purchases like a new vehicle. Union Bank has partnered with CIG, one of the nation’s largest credit unions, to provide members with competitive auto loan rates and flexible terms. This collaboration gives you access to affordable financing from two trusted institutions with a shared goal of helping you get the keys to your next car.

Union Bank and CIG Forge New Partnership

Union Bank and CIG Forge New Partnership

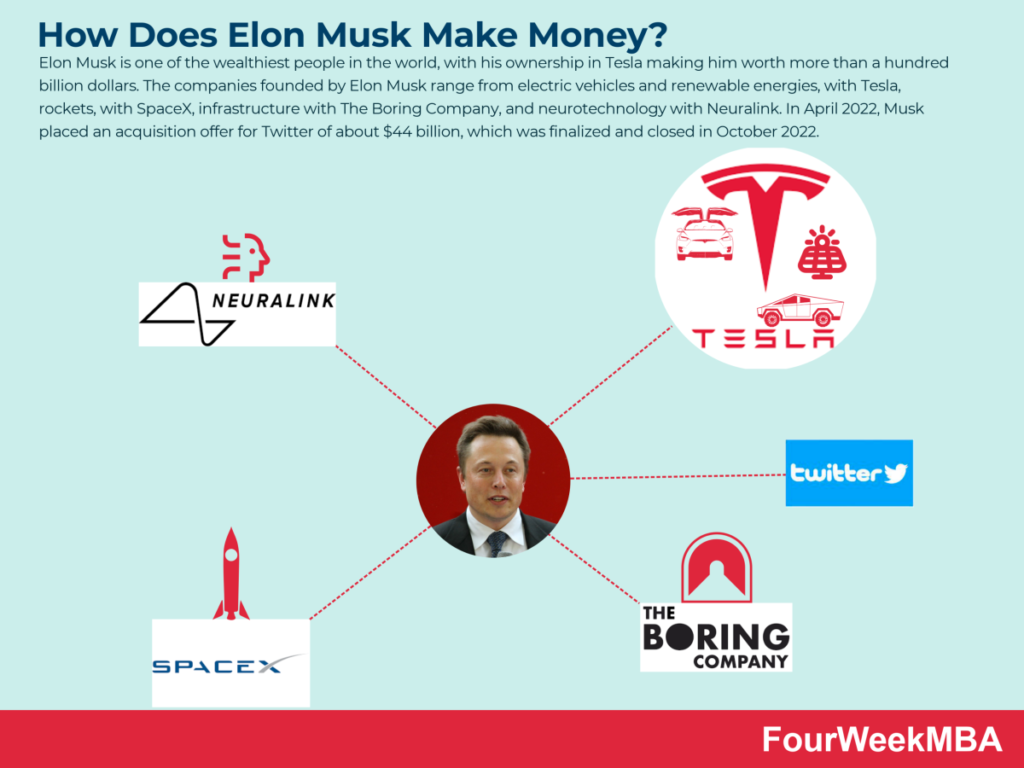

Union Bank recently announced an exciting new partnership with CIG, one of the nation’s top auto financing companies. This collaboration will allow Union Bank to provide vehicle financing to customers through CIG’s platform, expanding options for those looking to purchase new or used cars.

Union Bank customers will now have access to CIG’s wide range of auto financing solutions, including loans, leases, and refinancing. CIG offers highly competitive rates and terms, with many options for borrowers even those with little or no credit history. Union Bank clients can easily apply for CIG financing through Union Bank’s website or mobile app and receive a decision within minutes.

This partnership allows Union Bank to provide a valuable new service to customers without needing to build their own in-house auto financing division. By leveraging CIG’s established platform and experience, Union Bank can offer attractive financing deals to clients looking to purchase vehicles. At the same time, CIG gains exposure to Union Bank’s extensive customer base, enabling them to expand into new markets.

For Union Bank customers, this collaboration translates into numerous benefits. In addition to convenient online applications and quick approval times, borrowers will enjoy competitive interest rates, flexible loan terms, and the opportunity to finance a larger portion of the vehicle price. They can also take advantage of CIG’s additional services like rate discounts for automatic payments or rate matching for refinancing existing auto loans. Overall, this partnership with CIG allows Union Bank to enhance the experience for customers at every stage of the auto buying process.

This new collaboration is a prime example of how strategic partnerships between financial institutions can open up opportunities for growth and allow companies to better serve their clients. By working together, Union Bank and CIG have forged an alliance that will make the vehicle purchasing experience faster, more affordable, and more satisfying for customers.

How the Union Bank-Cig Partnership Benefits Customers

The recent partnership between Union Bank and CIG allows customers greater access to auto financing options. Here are the main benefits of this collaboration:

Union Bank customers now have more choices for vehicle loans and leases. CIG is one of the nation’s largest sources of indirect auto financing, with the ability to serve customers across the credit spectrum. This means both prime and non-prime borrowers can take advantage of competitive rates and flexible terms through CIG.

The application and approval process is streamlined. Customers can apply for CIG financing directly at Union Bank and receive a decision within minutes. This convenience allows customers to shop for vehicles with confidence, knowing they have already been pre-approved for a loan.

There are opportunities for discounts and special offers. As a Union Bank customer, you may be eligible for lower interest rates, cash back, and other incentives through CIG. These types of promotions are frequently available, especially around holidays and seasonal events.

A range of loan and lease options are available. Whether you want to finance a new or used vehicle, borrow a small or large amount, or prefer a short- or long-term contract, CIG likely has a solution to meet your needs. Options include standard installment loans, balloon payment loans, and flex loans with variable terms.

In summary, the partnership between Union Bank and CIG creates advantages for customers seeking auto financing. From quick approvals and discounts to flexible terms and a wide range of choices, this collaboration aims to provide an exceptional experience for vehicle buyers. By leveraging the resources of both organizations, customers can drive off the lot in a new ride, knowing they received the best deal and service.

Flexible Financing Terms Now Available

Union Bank’s new partnership with CIG now provides customers with more flexible auto financing options. ###Competitive Rates and Terms

Union Bank is committed to offering competitive rates and terms for auto loans. Now, with CIG as a lending partner, Union Bank can provide even lower rates and longer repayment terms for qualified borrowers. This means customers can get approved for the vehicle they want with an affordable monthly payment and loan term from 24 to 84 months.

Pre-Approval Available

For customers looking to buy from a private seller or at an auto auction, Union Bank and CIG offer pre-approval for auto financing. With a pre-approval, customers know exactly how much they can borrow before they start shopping. This allows them to negotiate the best deal on their desired vehicle with confidence. Pre-approvals are available for up to 60 days.

Easy Application Process

The auto loan application process is simple and straightforward. Customers can apply online, in person at a Union Bank branch, or over the phone. For qualified applicants, approval typically takes just a few minutes. Required documentation includes:

- Proof of income (pay stubs, tax returns, etc.)

- Residency information (utility bill, rental agreement, etc.)

- Personal information (Social Security number, driver’s license, etc.)

- Information on the vehicle (make, model, mileage, etc.)

Additional Benefits

In addition to competitive rates and flexible terms, Union Bank auto loans also come with:

- No prepayment penalties: Pay off your loan early without penalty fees.

- GAP insurance: Protect yourself from owing more than the value of your vehicle in the event of a total loss.

- Mechanical breakdown protection: Help cover unexpected repair costs to keep your vehicle on the road.

With the partnership between Union Bank and CIG, customers now have even more opportunities to get approved for an affordable auto loan. Contact your local Union Bank branch or apply online to get started.

Wider Range of Vehicles Now Accessible

Union Bank’s new partnership with CIG now provides customers with access to a wider range of vehicle financing options. ###Expanded Inventory

Union Bank customers looking to finance a new or used vehicle now have more choices available through CIG’s nationwide network of over 15,000 dealerships. Whether you’re interested in an eco-friendly hybrid, a reliable sedan, or a spacious minivan or SUV, CIG’s diverse selection of domestic and imported makes and models means there’s a vehicle for every need and budget.

Flexible Terms

CIG offers competitive interest rates and flexible loan terms up to 72 months. Union Bank customers can choose between fixed-rate or variable-rate financing to find an affordable payment plan that fits their needs. CIG’s simple application process and rapid approval times mean you can find the right vehicle and drive off the lot in no time.

Additional Benefits

Union Bank customers financing through CIG will also enjoy additional perks like complimentary roadside assistance, discounted insurance rates, and rebates of up to $1,000 on select new vehicles. CIG’s dedication to providing an excellent customer experience at every step of the vehicle buying process gives you the confidence that your needs will be handled promptly and professionally.

By partnering with CIG, Union Bank can now offer customers a full range of auto financing solutions to meet diverse needs. From affordable used sedans to high-end luxury vehicles, CIG’s huge selection, competitive rates, and additional benefits open up more opportunities for Union Bank customers to get behind the wheel of the vehicle they want. For more information or to get started on an auto loan application, visit your local Union Bank branch or go to unionbank.com/auto-loans. Our auto lending specialists are ready to walk you through all the options and help you drive off in your next vehicle.

The Convenience of One-Stop Shopping

Convenience and Efficiency

Partnering with CIG Financial allows Union Bank to provide customers with a streamlined auto financing experience. Rather than having to apply for a loan with one company and purchase a vehicle from another, customers can handle the entire process in one place.

Seamless Application Process

Applying for auto financing through Union Bank and CIG is simple and straightforward. Customers can begin the application on Union Bank’s website or mobile app and then finish at a CIG dealership, or start in person at a dealership and complete the remaining steps online. The integrated application uses information customers have already provided to pre-populate forms, reducing the amount of paperwork needed.

Flexible Options

Union Bank and CIG offer customers a variety of auto financing solutions to suit different needs and budgets. Choices include standard vehicle loans and leases with competitive interest rates, as well as loans for private party auto purchases. Terms range from 24 to 72 months for new and used cars, trucks, and SUVs. Union Bank aims to provide financing for customers at every stage of life and income level.

Ongoing Support

The partnership between Union Bank and CIG Financial does not end once a customer purchases a vehicle. Union Bank continues to service auto loans for the life of the financing agreement, allowing customers to make payments and access their accounts through Union Bank’s digital banking services. CIG also offers additional benefits like routine maintenance plans and roadside assistance programs for extra convenience and value.

By teaming up with CIG Financial, Union Bank can give customers an all-in-one auto buying and financing experience. From applying for a loan to finding and purchasing a vehicle to making payments over time, the process is designed to be as straightforward and hassle-free as possible. The range of options and ongoing support available through this partnership provides real value to Union Bank customers at every step of the journey.

How to Qualify for Union Bank Auto Financing

To qualify for auto financing through Union Bank’s partnership with CIG, you must meet several requirements.

Income Verification

You will need to provide proof of income through recent pay stubs, tax returns, or bank statements showing direct deposit of your paycheck. Your income should be sufficient to cover your monthly vehicle payment, insurance costs, and other obligations. Union Bank typically looks for a debt-to-income ratio below 36% for approval.

Credit Check

Union Bank will review your credit report and score to determine your eligibility and terms. They consider scores of 650 and above to be prime, while subprime scores between 550 to 649 may still qualify but with higher interest rates. If you have bad credit or no credit history, you may need a co-signer with good credit to be approved.

Down Payment

While Union Bank does offer 100% financing for well-qualified buyers, providing a down payment of at least 20% of the vehicle’s selling price can help you get approved with better terms. The more money you put down, the lower your monthly payment and interest charges will be over the life of the loan.

Trade-In Valuation

If you plan to trade in your current vehicle as part of the deal, Union Bank will evaluate its condition and mileage to determine its estimated trade-in value. The equity in your trade-in, if any, can be used as part of your down payment for the new vehicle purchase. Be prepared to provide records of any major mechanical work or reconditioning to help maximize your trade-in offer.

Co-Signer (if needed)

For those with bad or no credit, providing a co-signer with good credit can make it possible to qualify for auto financing that might otherwise be unavailable or come with very high interest rates. The co-signer agrees to take on equal responsibility for the loan payments if you fail to pay as agreed. Choose a co-signer carefully and make sure they understand their obligations before signing the loan documents.

Following these steps and preparing the necessary documentation can help streamline the auto financing process with Union Bank and CIG. With pre-approval, you can shop at participating dealerships with confidence, knowing the specific vehicle price range and terms for which you qualify.

Competitive Interest Rates and Fees

Union Bank’s partnership with CIG now provides competitive rates and fees for auto financing. Customers benefit from:

Low Interest Rates

Union Bank and CIG are able to offer lower interest rates than most other lenders due to their long-standing relationship and volume of auto loans issued. Interest rates typically range from 2.49% to 5.99% APR for new vehicles and 3.49% to 6.99% APR for used vehicles, depending on your credit score and other factors. These rates are often 1-2% lower than average.

Minimal Fees

Union Bank and CIG aim to keep fees to a minimum. There are no application fees, origination fees or prepayment penalties. Late fees are capped at $15 to $30, depending on your loan terms. The only fee you can expect to pay is a lien recording fee to formally note the lender’s secured interest in your vehicle title – typically under $50.

Flexible Terms

Union Bank and CIG provide auto loans with terms from 24 to 84 months so you can choose what best fits your budget. Longer terms of 60-84 months will have higher interest rates but lower monthly payments. Shorter terms of 24-36 months will have lower rates but higher payments. Select a term that allows you to pay off the loan as quickly as possible while still being affordable.

Pre-Approval

Get pre-approved for your auto loan before shopping at a dealership. This allows you to negotiate the best deal from a position of strength and speed up the purchasing process. Union Bank and CIG can pre-approve you for a certain loan amount and interest rate, which is subject to a final review of the vehicle details. Pre-approval typically takes just a few minutes and a soft credit check.

By partnering with CIG, Union Bank can provide competitive rates and minimal fees for auto financing. Flexible terms and a streamlined pre-approval process make the experience easy and affordable. Check your eligibility and apply today to start saving money on your next vehicle purchase.

Applying for Union Bank Auto Financing

To apply for auto financing through Union Bank and CIG, follow these steps:

Gather Required Documentation

To begin the application process, gather the necessary documentation, including:

- Your government-issued photo ID (driver’s license or passport)

- Proof of income (pay stubs, tax returns, bank statements)

- Proof of residence (utility bills, rental agreement)

- Information on the vehicle you wish to finance (VIN, make, model, mileage)

Apply Online or In-Branch

You can apply for Union Bank auto financing on their website or by visiting your local branch. Applying online is often quicker, while applying in-person allows you to get guidance from a Union Bank representative. Either way, be prepared to provide the documentation gathered in Step 1.

Review and Sign Final Paperwork

If your application is approved, Union Bank will provide final paperwork to review and sign, either electronically or in-person. This includes the final terms and conditions of your auto loan, including the interest rate, loan amount, and repayment schedule. Be sure you fully understand the details before signing the final documents.

Make Your First Payment

Once the final paperwork is signed, you can take possession of your new vehicle. Union Bank will provide details on making your first loan payment, typically due within 30 days of signing the final documents. Auto payments are usually deducted automatically from your bank account for convenience.

By following these steps and providing the necessary documentation, you can apply for and obtain auto financing through the partnership between Union Bank and CIG. With competitive rates and flexible terms, they aim to make the vehicle purchasing process as straightforward as possible for customers. Please let a Union Bank representative know if you have any other questions about applying for auto financing.

Union Bank Auto Financing FAQs: Commonly Asked Questions Addressed

As a Union Bank customer financing a vehicle through CIG, you likely have some questions about the process and your options. Here are answers to some of the most frequently asked questions regarding Union Bank auto financing.

What types of vehicles can I finance through Union Bank and CIG?

Union Bank and CIG offer auto financing for both new and used vehicles from private sellers or franchised dealerships. You can finance sedans, SUVs, trucks, hybrids, and electric vehicles. Classic cars may also be eligible for financing on a case-by-case basis.

What is the loan application process?

Applying for an auto loan through Union Bank and CIG is simple and straightforward. You can start an application on Union Bank’s website or by visiting a Union Bank branch. You will need to provide information like your income, employment, and the vehicle details. Union Bank will review your application and credit to determine your eligibility and the terms of your loan. Approved applications typically close within 1 to 2 business days.

What are my repayment options?

Union Bank offers flexible repayment terms for auto loans, typically 24 to 72 months. You can choose a repayment plan that fits your budget and financial needs. Longer terms like 60 or 72 months will have lower payments but higher interest paid over the life of the loan. Shorter terms such as 24 or 36 months will have higher payments but lower interest costs. You can also pay extra towards your principal balance at any time with no prepayment penalty.

What interest rates and fees can I expect?

Interest rates for Union Bank auto loans will depend on your credit score, loan term, and other factors. Rates currently range from 2.99% to 9.99% APR for qualified borrowers. Union Bank does not charge application fees, origination fees or prepayment penalties on auto loans. Late payment and returned payment fees may apply if payments are not made on time.

Please let us know if you have any other questions about Union Bank auto financing. We are happy to help explain the process and your options in more detail.

Conclusion

As a consumer, you now have more options than ever to finance your next vehicle purchase. The new partnership between Union Bank and CIG Financial means greater flexibility, competitive rates, and a streamlined process. By leveraging CIG’s nationwide network of over 6,000 auto dealers and Union Bank’s robust lending platform, you’ll benefit from a seamless experience from the showroom to the open road. The power of this strategic alliance cannot be overstated. Two industry leaders have come together to deliver an unparalleled solution for your auto financing needs. The next time you’re shopping for a new or used vehicle, be sure to ask if the dealer participates in the Union Bank and CIG program. You’ll be glad you did. The road ahead looks bright.